From the Strategy to the Product

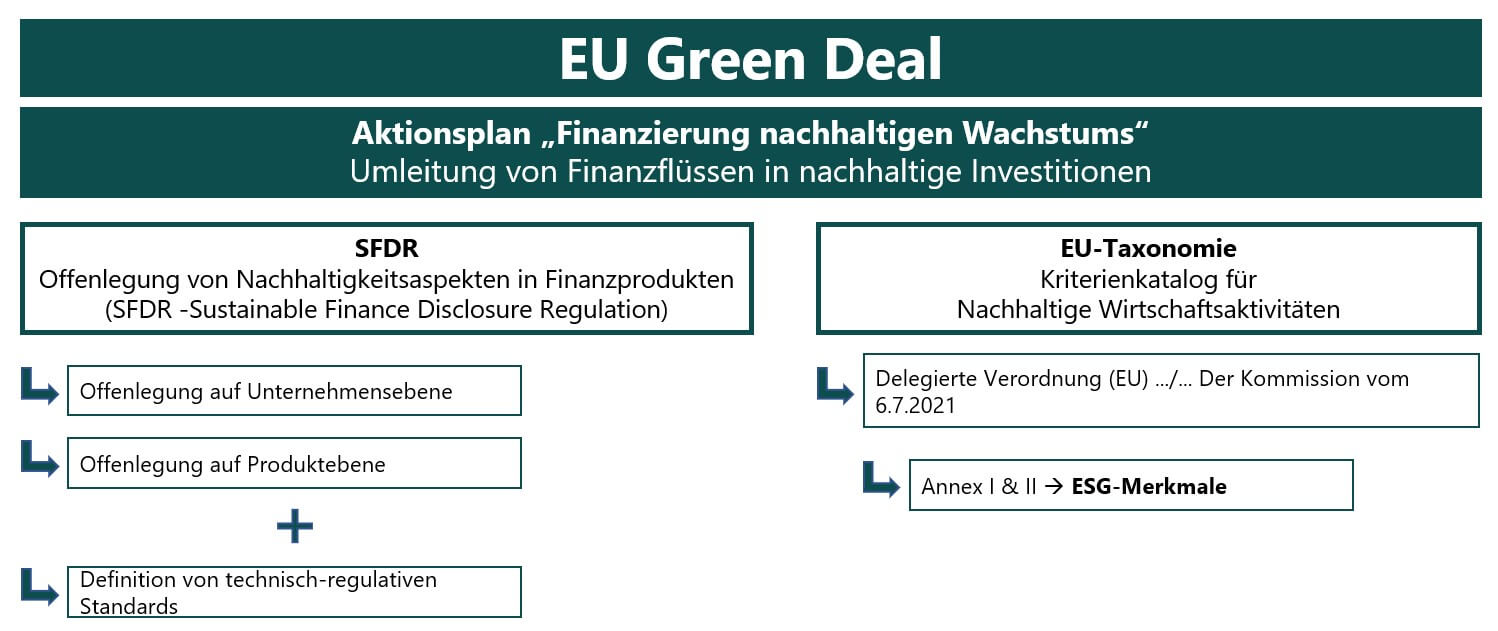

Now that the Sustainable Finance Disclosure Regulation (SFDR) has been implemented, sustainability has finally arrived in the real estate industry. ESG (environmental, social and corporate governance) is an entrepreneurial responsibility which, when properly exercised, offers many opportunities along with the associated duties.

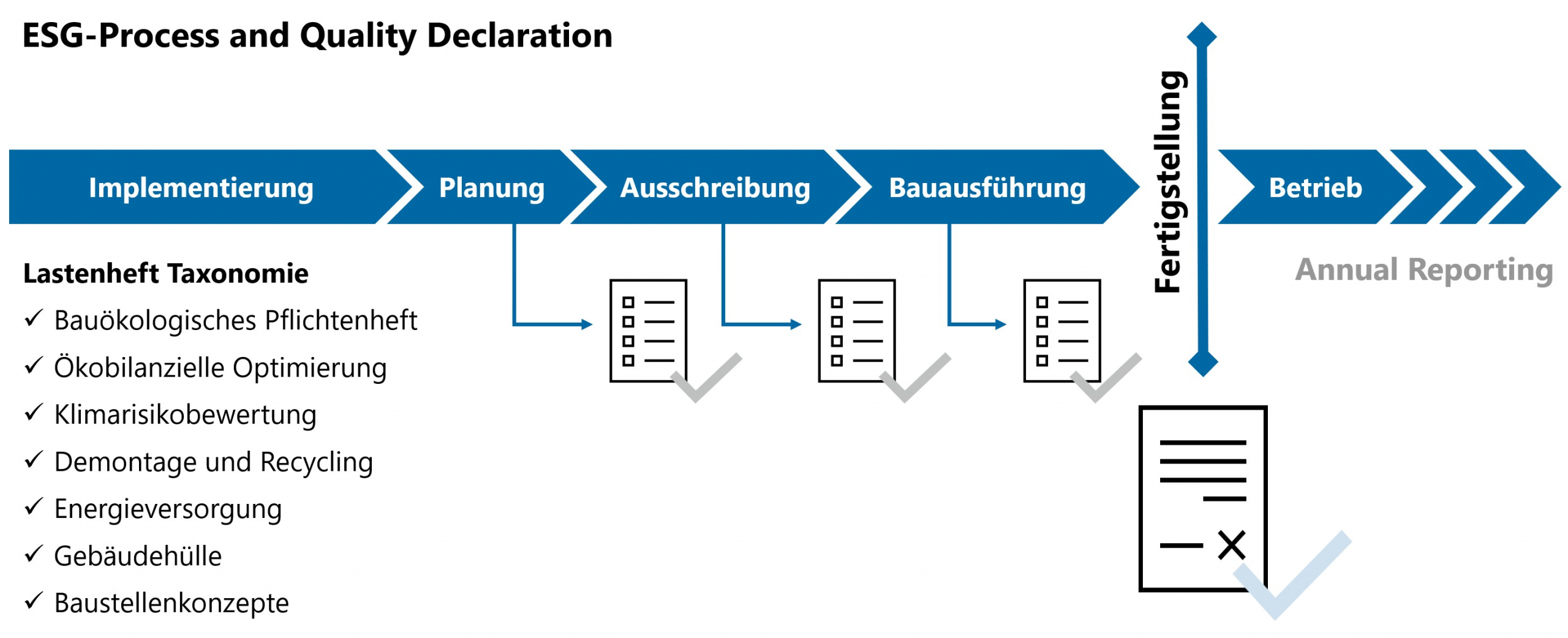

ikl GmbH support you in developing a custom-tailored ESG strategy and implementing it at the corporate and product levels.

Fund Concept in Accordance with Article 9 SFDR

Article 9 funds must fulfil specific transparency requirements and provide detailed information on their sustainable investment strategy and the type of positive impact they expect to make. This enables investors to make well-informed decisions and identify sustainable investment opportunities.

With our 20 years of experience related to the sustainable construction and operation of properties, we help you to define the right sustainability targets, make your objectives measurable, and control and communicate the achievement of your targets.

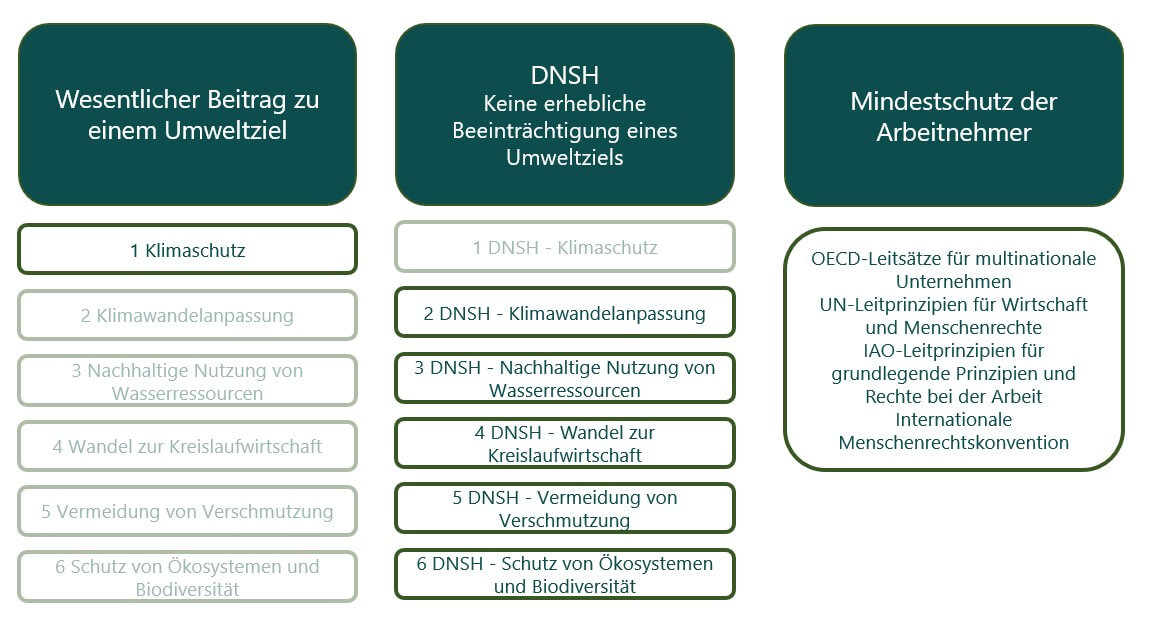

ESG Verification in Line with the EU Taxonomy

To verify the compliance of properties with the criteria of the EU taxonomy, the DGNB offers its own ESG verification for the property sector. It can be applied for the following economic activities defined in the Taxonomy: new construction, renovation and modernisation, acquisition, and ownership.

In addition to documentation of the project’s compliance with the EU taxonomy, companies that take advantage of the ESG verification of the DGNB receive a report about the detailed results and, therefore, information on where there is a specific need for adjustment.

We create the required calculations and documentation for you, and submit the documents to the DGNB for verification.